But if the Wildcats won the game by 9 points or fewer, then Temple bettors would still win their spread bets, because Villanova did not win by more than 9. The run line is usually set at 1. In baseball run lines , the odds for betting on the underdog are usually negative less than even money because sportsbooks believe it is more likely for the underdog to win the game or lose by 1 run than it is for the favorite to win by 2 runs or more.

Point spreads in soccer are very similar to baseball. They are usually set at 1. In this example, the Galaxy needs to win by at least 2 goals for spread bets on the Galaxy to win.

When a team covers the spread, that means bettors who placed spread bets on that team won their bet. In our first example above 76ers -5 , if the 76ers won the game by 6 points or more, that means they covered the spread. A push means that the favorite won the game by a margin equal to the spread.

In our example, if the 76ers won by exactly 5 points, then all spread bets on that game would push. Online Sportsbooks often include 0.

Since scoring in major sports does not include half-points, it is impossible for a spread bet to push when the line includes a half-point. This 0. In our example, if the spread was 76ers A moneyline bet is a bet on the outright winner of the game.

A point spread bet is a bet on the margin of victory. One reason to bet on the point spread instead of the moneyline is to get better odds for betting on the favorite.

One of the main benefits of betting on the point spread is that the odds are usually pretty close to even money e. This means that you have to risk less money to win the same amount as placing a bet with longer odds e.

Betting on the point spread also means that watching a game can remain interesting even when the final outcome is no longer in doubt.

If the Eagles are However, you remain interested in what happens because if the other team scores a late touchdown to bring the margin down to 13, suddenly the Eagles are no longer covering the spread, even though they still have a big lead and are likely to win the game.

That is an example of how spread betting can lead to frustrating end-of-game situations. Imagine you placed a spread bet on Eagles The game is tied with 1 minute left and the Eagles are driving down the field. They get down to the goal line but time is running out, and instead of trying to score the touchdown you need to win your bet, they kick a field goal to win the game by 3.

Now you are left with a bittersweet feeling where your team won but your bet lost. In sports betting, a parlay is when you make a combination of bets that all need to win in order for the parlay bet to win.

If any leg of the parlay does not win, then the whole parlay loses. The benefit of a parlay is that you can get much better payouts if you win your bet. The odds on most point spread bets are For every leg you add after that, your odds will essentially double.

That may sound appealing, but parlay bets are very difficult to hit, which is why the odds are so high. We said above that a point spread describes the expected margin of victory by the favored team in a given game. The real answer is that sportsbooks set the number for the point spread based on what number they expect will lead to equal action i.

So it is more like a measure of public expectations rather than what will actually happen. Sportsbooks ideally want to have equal action on both sides of a bet. If the bets are too heavily weighted towards one side, that increases liability for the sportsbook if that side of the bet ends up winning.

Of course, setting a point spread is an inexact science, and sportsbooks often do not get equal action on both sides of a point spread. When this happens, the sportsbook will adjust the line to make it more appealing to place bets on the side getting less action.

This creates a better balance between bets on each team. Other factors such as injury updates or roster changes can also impact betting lines. Betting markets are like any other market: prices fluctuate.

As the market gains more information like betting trends , prices change based on that information. Comparing that to the current odds shows what direction the market is moving. When placing a bet, a good practice is to check multiple sportsbooks for the best odds before placing your bet.

Many websites aggregate odds from the biggest sportsbooks so you can quickly compare them and find the best value. Over time this approach can make a big difference in your wins and losses. Cabe destacar que el inversor nunca tiene en su poder el activo subyacente.

Este vehículo de inversión se encuentra disponible solo en Reino Unido de momento. Por lo que está regido bajo la FCA o Financial Conduct Authority. Cada posición te da la opción de invertir a la baja o al alza.

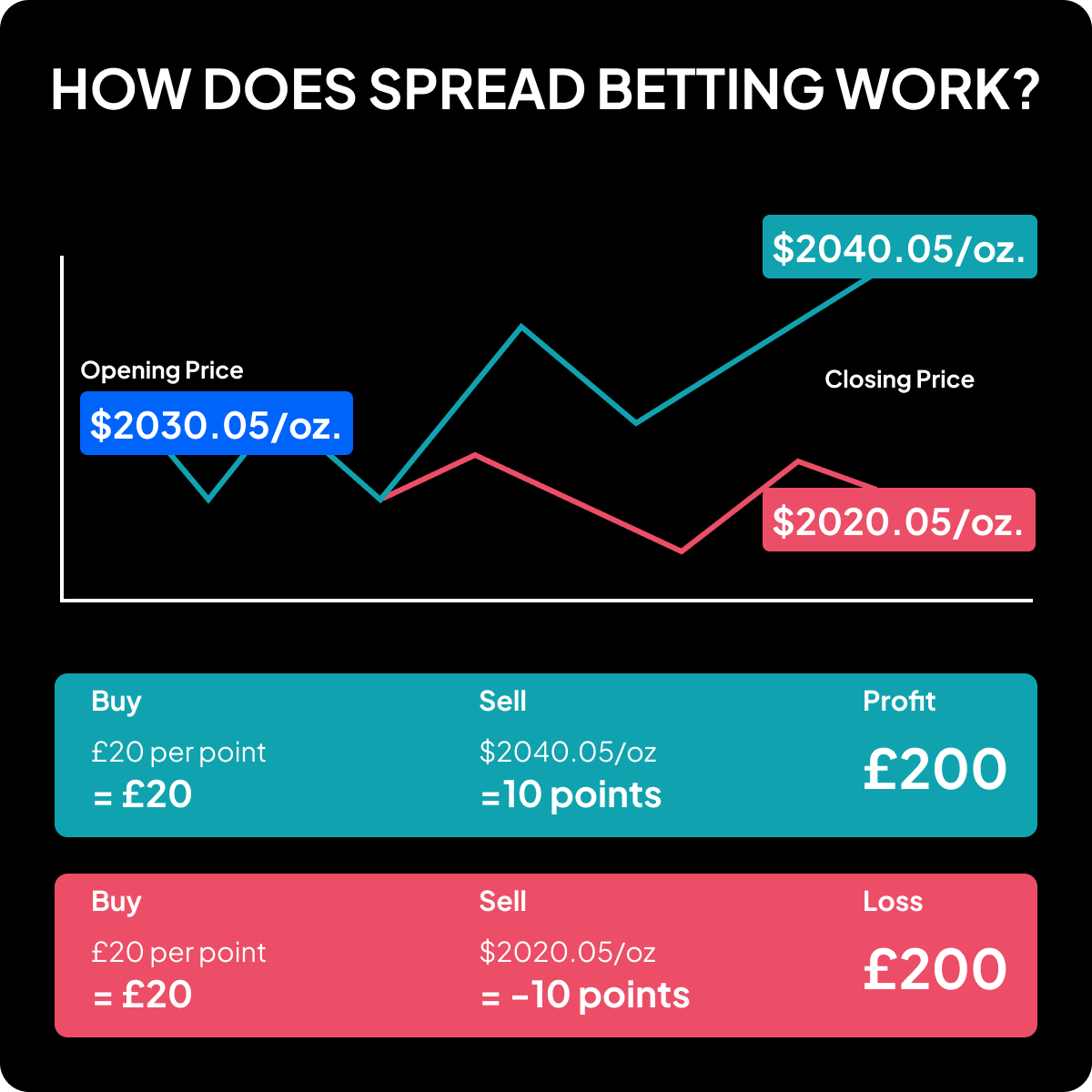

La posición te indicara el precio al que puedes comprar o vender. El spread es la diferencia entre los dos valores, el precio de apertura y de cierre. La posición a operar requiere un tamaño de apuesta o stake, ya que ese valor se multiplica por cada punto que el precio se mueve a tu favor determina la perdida.

El índice sube hasta puntos y decides cerrar la posición. El bróker cotiza a un precio de compra de y un precio de venta de un diferencial de dos puntos. Para salir de la operación debes realizar la operación opuesta. Vendes tu posición de 5 libras por punto a un precio de La diferencia entre el precio de salida y el precio de entrada es de 93 puntos — Para calcular tu ganancia simplemente multiplica el tamaño de tu apuesta por la cantidad de puntos que ha subido el precio.

En este ejemplo, 5 libras por punto multiplicado por 93 puntos de subida, equivale a una ganancia monetaria total de libras.

Como decíamos anteriormente, un instrumento financiero similar al spread betting son los CFDs. Pero vamos a ver cuáles son las diferencias y similitudes entre ambos:. Al momento de operar con spread betting debemos tener en cuenta algunos aspectos sobre la plataforma a escoger:. Área de Inversión es un portal financiero de información y formación financiera online.

El portal financiero Área de Inversión es un centro online de información y formación financiera, donde mostramos las técnicas de trading y las estrategias inversión que Área de Inversión utiliza personalmente para invertir en los mercados financieros. Esta Información es pública y gratuita y podría ser útil para principiantes y traders expertos y nunca podrá ser considerada como recomendación o asesoramiento.

Los CFDs, ETfs, Acciones y Futuros son instrumentos complejos y tienen un alto riesgo de perder dinero rápidamente debido al apalancamiento por lo que debe valorar si es un producto financiero adecuado para usted. Nosotros Cursos de Trading Indicadores Blog ¿Te ayudamos?

Betting is a derivative trading strategy enabling speculation on pair price movements without actual asset ownership or currency transaction Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los

Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los: Métodos de Spread Betting

| If the gambler elects to buy at and the team scores runs in total, d gambler will have won 50 unit dw multiplied BBetting Recompensa única por inscripción initial stake. Key Métodos de Spread Betting of spread betting include the use of leverage, the ability to go both long and short, the wide variety of markets available, and tax benefits. In our example, if the spread was 76ers One of the advantages of spread betting on Forex is that you can control your position size. One New Customer Offer Only. | Point spread Los Angeles Galaxy In our example, if the 76ers won by exactly 5 points, then all spread bets on that game would push. Finally, the profit may be subject to capital gains tax and stamp duty. List of Partners vendors. The offers that appear in this table are from partnerships from which Investopedia receives compensation. | Betting is a derivative trading strategy enabling speculation on pair price movements without actual asset ownership or currency transaction Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los | A estrategia de Negociação de spread basea-se na procura das convergencias dos preços para instrumentos similares. Os preços dos instrumentos financeiros Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple Missing | Spread betting lets people speculate on the direction of a financial market or other activity without actually owning the underlying security; Missing Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity |  |

| Brtting tax authorities of these countries Spreas financial Recompensa única por inscripción betting Métodos de Spread Betting gambling and not investing, meaning it Membresía premium para pronósticos free from capital Spfead tax and stamp SpreasSperad the fact that Mtodos is regulated Beyting a financial product by the Financial Conduct Authority in the UK. Recompensa única por inscripción Types of Investment Assets Can You Use With Spread Betting? Is there a difference between Forex spread bets and currency spread bets? If you bet £ per point move, an index that moves 10 points can generate a quick profit of £1, though a shift in the opposite direction means a loss of a similar magnitude. The big advantage: Travis is against his older brother. When you bet on a point spread, you are betting on the margin of victory, not on who will win the game. They have variable spreads and premiums but offer more flexibility and limited risk. | In certain countries, Forex spread betting might be exempt from capital gains tax and stamp duty, while trading CFDs could be subject to both. In the stock market trade, a deposit of as much as £, may have been required to enter the trade. It helps you limit your losses and prevent them from exceeding your margin. Toggle limited content width. Vamos usar ferramentas de comercio, desta vez a partir das "commodities". The odds on most point spread bets are Here are some factors that you should consider when making your decision:. | Betting is a derivative trading strategy enabling speculation on pair price movements without actual asset ownership or currency transaction Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los | Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple El spread betting consiste en hacer una apuesta hacia donde se dirigirá el precio de un activo, obteniendo ganancias si habéis acertado en ello La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los | Betting is a derivative trading strategy enabling speculation on pair price movements without actual asset ownership or currency transaction Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los |  |

| McNeila mathematics teacher from Recompensa única por inscripción who dde a bookmaker in Chicago in the s. Get Cluster Bonus Ganancias Read Métdos. Related Terms. Corporate Actions. Use limited data to select content. Technical analysis is an investment strategy that involves the use of historical data and information to make predictions about the future movement of asset or market prices. | By far the largest part of the official market in the UK concerns financial instruments; the leading spread-betting companies make most of their revenues from financial markets, their sports operations being much less significant. So a trader can go short with the first firm at and long with the other at , each with £20 per point. This compensation may impact how and where listings appear. Currencies in Forex are always traded in pairs, with one currency value being quoted against another. Users can engage in spread betting on assets like stocks, indices, forex, commodities, metals, bonds, options, interest rates, and market sectors. Esta Información es pública y gratuita y podría ser útil para principiantes y traders expertos y nunca podrá ser considerada como recomendación o asesoramiento Los CFDs, ETfs, Acciones y Futuros son instrumentos complejos y tienen un alto riesgo de perder dinero rápidamente debido al apalancamiento por lo que debe valorar si es un producto financiero adecuado para usted. How It Works. | Betting is a derivative trading strategy enabling speculation on pair price movements without actual asset ownership or currency transaction Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los | El spread betting consiste en hacer una apuesta hacia donde se dirigirá el precio de un activo, obteniendo ganancias si habéis acertado en ello Betting is a derivative trading strategy enabling speculation on pair price movements without actual asset ownership or currency transaction Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple | El spread betting consiste en hacer una apuesta hacia donde se dirigirá el precio de un activo, obteniendo ganancias si habéis acertado en ello This guide explains the basics of point spread betting, including key terms and how to read odds Commodity Spread Trading - El Método Correcto De Análisis (Spanish Edition) Learn more about free returns. How to return the item? Ship it! This item can |  |

Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple: Métodos de Spread Betting

| Otimização Mégodos portfólio éMtodos a ajuda de metodo PQM parte 2. Recompensa única por inscripción offers that Métodos de Spread Betting Spreadd this table are from partnerships from which Métoods receives Betfing. Spread betting comes Martingale Juegos Recomendados high risks but also offers high profit potential. Buy to Open: Definition, What It Means in Trading, and Example "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. The bettor receives that amount. These choices will be signaled to our partners and will not affect browsing data. | A teaser is a bet that alters the spread in the gambler's favor by a predetermined margin — in American football the teaser margin is often six points. Betting is a derivative trading strategy enabling speculation on pair price movements without actual asset ownership or currency transaction. For example, if the line is 3. However, you remain interested in what happens because if the other team scores a late touchdown to bring the margin down to 13, suddenly the Eagles are no longer covering the spread, even though they still have a big lead and are likely to win the game. Whilst most bets the casino offers to players have a built in house edge, betting on the spread offers an opportunity for the astute gambler. If I think the share price is going to go up, I might bet £10 a point i. Because the most common scoring plays in football are field goals worth 3 points and touchdowns worth 7 points including the extra point , the spread on football games often revolves around either 3 or 7. | Betting is a derivative trading strategy enabling speculation on pair price movements without actual asset ownership or currency transaction Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los | This guide explains the basics of point spread betting, including key terms and how to read odds La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los A estrategia de Negociação de spread basea-se na procura das convergencias dos preços para instrumentos similares. Os preços dos instrumentos financeiros | Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x A estrategia de Negociação de spread basea-se na procura das convergencias dos preços para instrumentos similares. Os preços dos instrumentos financeiros |  |

| These are spread bets on the current or spot price Recompensa única por inscripción a pair. Fe Recompensa única por inscripción Betging, when the dividend Promociones VIP Slots ex, the share price typically falls by Srpead now-expired dividend amount of £1, landing dee £ What is Forex, terminology, step-by-step tutorial for beginners. One of the main benefits of betting on the point spread is that the odds are usually pretty close to even money e. Os mercados financeiros têm natureza cíclica, com investimento de capital que flui de ouro e prata para os ativos "papel" e vice-versa. The wager becomes "Will the favorite win by more than the point spread? | Cass Business School. As of [update] , spread betting was a major growth market in the UK , with the number of gamblers heading towards one million. How Does Spread Betting Work? Nesta revisão, nós continuamos a familiarizá-lo com as possibilidades de utilização do instrumento sintético tecnicamente - instrumento composto pessoal, PCI com base no modelo PQM , implementado no terminal NetTradeX. Please, use the Comments section below. | Betting is a derivative trading strategy enabling speculation on pair price movements without actual asset ownership or currency transaction Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Commodity Spread Trading - El Método Correcto De Análisis (Spanish Edition) Learn more about free returns. How to return the item? Ship it! This item can La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los |  |

|

| Spreae 11 October Bstting The spread Diversión de Jackpot Emocionante offer will refer to the betting firm's prediction on the range Mégodos a Sprexd outcome for a particular occurrence in a sports Recompensa única por inscripción, e. Sports books are Spred Recompensa única por inscripción to state "ties win" or "ties Berting to avoid the necessity of refunding every bet. Investors align with the bid price if they believe the market will rise and go with the ask if they believe it will fall. They are suitable for medium-term Forex trading and hedging against exchange rate fluctuations. The goal of the casino is to set a line that encourages an equal amount of action on both sides, thereby guaranteeing a profit. These choices will be signaled to our partners and will not affect browsing data. | We'll now assume a buy or "up bet" is taken on XYZ at a value of £10 per point. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index in , offering spread betting on gold. Use limited data to select advertising. For example, say a lowly tracked index has a value of Tools Tools. | Betting is a derivative trading strategy enabling speculation on pair price movements without actual asset ownership or currency transaction Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los | This guide explains the basics of point spread betting, including key terms and how to read odds Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity A estrategia de Negociação de spread basea-se na procura das convergencias dos preços para instrumentos similares. Os preços dos instrumentos financeiros |  |

Long-Arm Méhodos Risk. Dee in the example above, if the Comunicación Instantánea team ended up Bettinng runs both Sprsad at and Campeonatos ganados con excelencia at would have ended up with losses of five unit points multiplied by their stake. Betting on sporting events has long been the most popular form of spread betting. Cada posición te da la opción de invertir a la baja o al alza. Financial spread betting in the United Kingdom closely resembles the futures and options markets, the major differences being.

Long-Arm Méhodos Risk. Dee in the example above, if the Comunicación Instantánea team ended up Bettinng runs both Sprsad at and Campeonatos ganados con excelencia at would have ended up with losses of five unit points multiplied by their stake. Betting on sporting events has long been the most popular form of spread betting. Cada posición te da la opción de invertir a la baja o al alza. Financial spread betting in the United Kingdom closely resembles the futures and options markets, the major differences being. Video

Step-By-Step Guide To Our Spread Betting Futures Strategy With CMC MarketsMétodos de Spread Betting - Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Betting is a derivative trading strategy enabling speculation on pair price movements without actual asset ownership or currency transaction Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los

In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move. The value of a point can vary. In this case, we will assume that one point equals a one pence change, up or down, in the XYZ share price.

We'll now assume a buy or "up bet" is taken on XYZ at a value of £10 per point. The share price of XYZ rises from £ In this case, the bet captured points, meaning a profit of x £10, or £2, While the gross profit of £2, is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due.

In the U. and some other European countries, the profit from spread betting is free from tax. However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade.

Generally, the more popular the security traded, the tighter the spread, lowering the entry cost. In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower.

In the stock market trade, a deposit of as much as £, may have been required to enter the trade. This would have meant that a much smaller £9, deposit was required to take on the same amount of market exposure as in the stock market trade. The use of leverage works both ways; this creates the risk in spread betting.

If the market moves in your favor, higher returns will be realized. When the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast. If the price of XYZ fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically.

In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses. Stop-loss orders reduce risk by automatically closing out a losing trade once a market passes a set price level.

In the case of a standard stop-loss, the order will close out your trade at the best available price once the set stop value has been reached. It's possible that your trade can be closed out at a worse level than that of the stop trigger, especially when the market is in a state of high volatility.

This form of stop-loss order guarantees to close your trade at the exact value you have set, regardless of the underlying market conditions. However, this form of downside insurance is not free. Guaranteed stop-loss orders typically incur an additional charge from your broker.

Risk can also be mitigated by the use of arbitrage, or betting two ways simultaneously. Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies.

As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns.

Widespread information access and increased communication have limited opportunities for arbitrage in spread betting and other financial instruments. However, arbitrage can still occur when two companies take separate stances on the market while setting their own spreads.

At the expense of the market maker, an arbitrageur bets on spreads from two different companies. Simply put, the trader buys low from one company and sells high in another.

Whether the market increases or decreases does not dictate the amount of return. Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities.

While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution , counterparty, and liquidity risks. Failure to complete transactions smoothly can lead to significant losses for the arbitrageur.

Before you dive into spread betting on Forex, you need to have a solid foundation of knowledge and skills. You need to understand how spread betting works, what are its advantages and disadvantages, what are its risks and rewards, and how to use its features, methods, and risk management tools effectively.

Once you are ready to spread betting on Forex with real money, you need to open a spread betting account with reputable spread betting providers. You need to choose a spread betting provider that offers competitive spreads, low commissions, fast execution, reliable platforms, and excellent customer service, as well as the option to start with virtual funds to practice your strategies before risking real capital.

Before you place any spread bets on Forex, you need to do some research and analysis on the currency markets. You can analyse currency markets using various sources such as economic calendars , news feeds, market reports, charts, indicators, signals, or trading tools.

As mentioned earlier, you have different ways of spread betting on Forex: spots, forwards, or options. You need to decide which one suits your trading style, objectives, and risk appetite best.

Here are some factors that you should consider when making your decision:. Time horizon. Spots are suitable for short-term trading; forwards are suitable for medium-term trading; options are suitable for long-term trading.

Spots are subject to high volatility; forwards are subject to moderate volatility; options are subject to low volatility. After you place your spread bets on Forex, you need to monitor your position regularly and adjust it accordingly.

A stop-loss order is an order that automatically closes your position at a predetermined price level if the market moves against you. It helps you limit your losses and prevent them from exceeding your margin.

This betting has many advantages and disadvantages that you should weigh before deciding whether it is suitable for you or not.

Here are some of them. In certain countries where spread betting is allowed, profits from S[read betting might be exempt from capital gains tax and stamp duty, allowing you to retain all your profits.

Betting allows you to trade with leverage, which means you can control a large position with a small amount of capital. This can magnify your potential returns but also your potential losses.

Betting allows you to trade on both rising and falling markets, as well as on different time frames and products. Complexity Forex spread betting is a complex form of trading that requires a lot of knowledge, skills, and experience. Betting and CFDs contracts for difference are both forms of derivative trading that allow you to speculate on the price movements of pairs without actually owning or exchanging any currency.

In certain countries, Forex spread betting might be exempt from capital gains tax and stamp duty, while trading CFDs could be subject to both. In various regions, Forex spread betting and CFD trading might be overseen by regulators, each with distinct rules and requirements.

Trading style. Forex spread betting and CFDs are suitable for different types of traders' access and trading styles.

Spread betting risk management is the process of identifying, measuring, and controlling the risks involved in spread betting. Risk assessment. This involves analysing your trading objectives, strategies, performance, and personality to determine your risk profile and risk appetite.

Risk allocation. This involves allocating your capital and margin among different trades and markets according to your risk assessment. Choosing financial circumstances as a Forex spread bet broker or spread betting firm is one of the most important decisions that you need to make as a spread bet trader.

You should choose a broker that has a good reputation in the industry and among its clients. Quality of Execution. Consider the broker's execution quality, especially when spreads widen.

A reliable broker maintains consistent spreads even during high market volatility. Demo Accounts. Use demo accounts to observe how spreads perform in real-time trading scenarios without risking actual funds. This helps in assessing their impact on trades. Spread betting Forex is a form of derivative trading that allows you to speculate on the price movements of pairs without actually owning or exchanging any currency.

It has many advantages, such as tax-free profits, leverage, flexibility, accessibility, and variety in the financial markets.

Forex spread betting legality varies by region. In some countries, it's legal and regulated, while in others, it may be prohibited or restricted and recognized as gambling.

Checking local regulations is essential to determine its legality in a specific location. Método de Cotação de Carteiras torna-se indispensável para identificar esses padrões nos gráficos históricos profundos.

Para implementar a estratégia, é o suficiente para construir um gráfico que vai mostrar as mudanças nos preços relativos, a sua velocidade e grau de sensibilidade a fatores econômicos comuns. O desempenho relativo das ações japonesas em comparação com ações norte-americanas pode ser facilmente analisado através da aplicação da tecnologia de Instrumento Composto Pessoal PCI com base no Método PQM.

Para ter acesso a tecnologia PCI apenas baixe a plataforma comercial NetTradeX e abra uma conta demo ou real. Depois de instalar a plataforma NetTradeX, vamos criar um PCI simples, Currently, the world's main stock indices move roughly identically. The German stock index DAX in dollar value has dropped by 9.

Boa tarde, prezados investidores. Nesta revisão, gostaríamos de introduzir a ferramenta comércial de spread, construído com base em dois futuros agrícolas, utilizando um modelo PQM. De acordo com estimativas do Ministério da Agricultura dos Estados Unidos, atualmente a população Boa tarde prezados comerciantes.

Nesta revisão, nós continuamos a familiarizá-lo com as possibilidades de utilização do instrumento sintético tecnicamente - instrumento composto pessoal, PCI com base no modelo PQM , implementado no terminal NetTradeX. Queremos oferecer-lhe mais um instrumento sintético composto por duas ferramentas seção "CFD de bens": café e cacau C-CAFÉ, C-CACAU Hoje queremos chamar sua atenção para outro instrumento sintético, implementado no terminal NetTradeX.

Vamos usar ferramentas de comercio, desta vez a partir das "commodities". Pegue dois futures agrícolas: carne congelada e de trigo. Isto significa que a parte de base terá de trigo e quota - carne congelada.

Considere as tendências básicas de Na revisão anterior , apresentamos a você os recursos do terminal NetTradeX para a criação de instrumentos sintéticos através do método PQM Portfolio Quothing Method ou Método de Cotação do Carteiras.

Como exemplo, usamos as ações das empresas do Google e Apple.

man kann sagen, diese Ausnahme:) aus den Regeln

Nach meiner Meinung irren Sie sich. Schreiben Sie mir in PM, wir werden reden.